Menu

Table of contents :

The Canada Pension Plan is a retirement and disability benefit program provided by the government of Canada that provides monthly payments to eligible Canadians. According to the official government of Canada website, the average CPP payment amount is $779.32/month, with up to a maximum of $1,433.00/month, depending on individual circumstances. In total, approximately 6.8 million people receive these types of benefits in the country.

A Canadian may receive CPP retirement benefits after contributing during their working years or CPP disability benefits due to a prolonged disability. Either way, these payments represent a stable source of income that arrives in a recipient’s bank account each month.

While Canada Pension Plan benefits can be incredibly helpful for those who receive them, there’s always the possibility that the amount isn’t enough to cover unexpected expenses like a sudden home repair, an urgent medical expense, or helping a family member in need.

This is why many Canadians turn to payday loans for government benefit recipients. It helps get that bit of extra cash to cover those expenses quickly. In this article, we’ll take a look at how the process looks to get a payday loan. Don’t worry, it’s easy!

Yes, the great news is that many payday lenders will consider your benefits as a valid form of stable income for loan approval. CPP retirement benefits and disability payments are government-backed payments and are seen as a reliable, predictable income.

While some traditional banks may have stricter requirements, many online and alternative lenders happily accept CPP income for payday loan applications.

At iCash, we accept all types of income, including CPP benefits and other forms of government assistance, too. Our automated system can quickly verify your eligibility, and with our 93% approval rate, there’s a great chance you’ll get approved once you apply.

The payday loan application process is designed to be simple, whether you’re a government benefit recipient or not. Here’s what you’ll need to know:

1. Meet General Requirements:

Be at least 18 years old (19 years old for applicants in British Columbia, New Brunswick, Nova Scotia)

Be a resident of any of the provinces in which we operate (AB, ON, BC, MB, NB, NS, PEI).

Show that you have been receiving the same source of income for the past three months.

Have a total net income of at least $800/month.

Have access to an online bank account, in which pre-authorized debits can be performed.*

Have a valid Canadian mobile phone number, address, and email address (VoIP numbers are not accepted)

*Please note that KOHO accounts do not qualify as they do not support pre-authorized debits.

2. Submit the Application: If you meet all the basic qualifications, then fill out the easy online application, which takes just minutes to complete. You can apply 24/7 from the comfort of your home using our website or mobile app available on iPhone and Android devices.

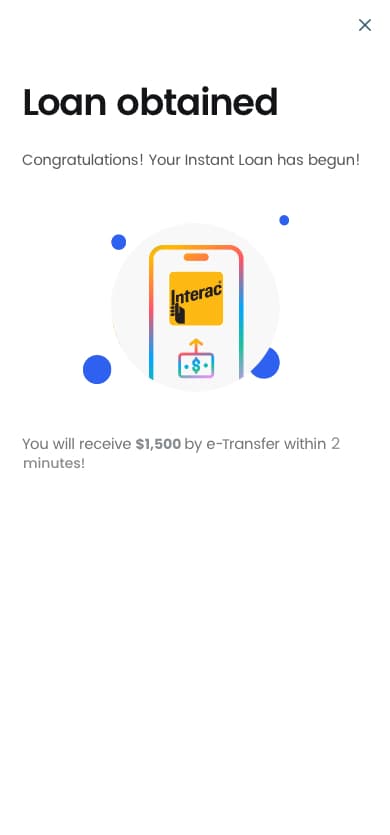

Once submitted, you'll receive an instant decision, and if approved, funds can be in your account within 2 minutes via e-Transfer.

Canadians have access to many government programs, which is why iCash offers payday loans for people receiving other benefit programs as well:

Benefit Program | Description |

Stable, predictable income accepted by many lenders for Ontario residents needing financial assistance | |

Provincial disability benefit providing reliable income source widely accepted by licensed Alberta lenders | |

Temporary benefit that some lenders accept, though borrowers should ensure repayment before benefits end |

Before making your final decision, take time to explore every alternative available to you and compare different payday lenders. Consider reaching out to family, friends, or community organizations that might offer assistance. Look into government programs that provide emergency financial support for seniors and individuals with disabilities.

Should you decide to choose iCash as your payday lender, our promise to you is that the entire process will be easy. Our customer service team will always be available to assist you with any and all questions you may have throughout the loan process. And once you're approved, we’ll make sure all the information and terms are spelled out clearly before you sign anything.

Ready to apply? Get up to $1,500 with your CPP income. Our fast, secure online process takes just minutes, with funds available 24/7!

[See How Much You Qualify For]

Learn more about CPP payment dates.

Since 2016, we've helped over 1.6 millions Canadians get instant loans online.

Since 2016, we've helped over 1.6 millions Canadians get instant loans online.

Read more reviews.

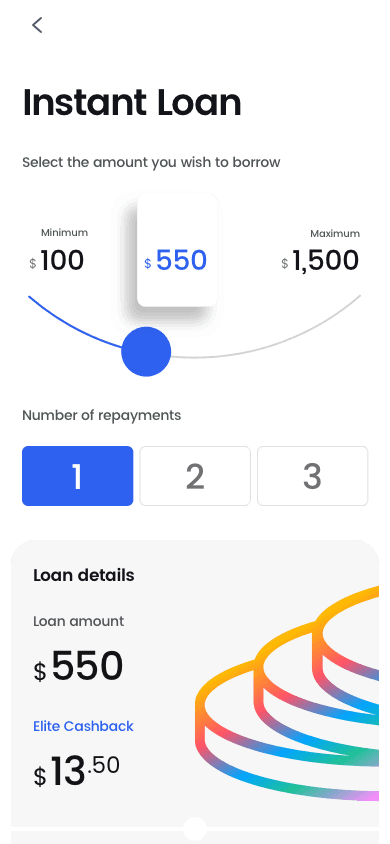

Getting an online loan with us is fast and easy. Simply select your loan amount, repayment plan* and provide some personal details.

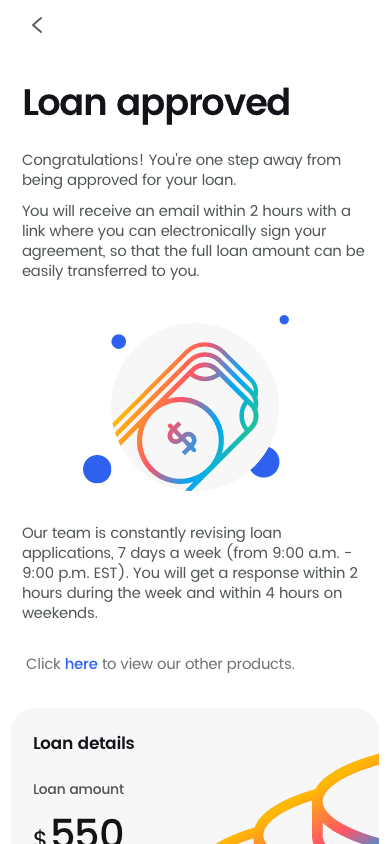

Our online loan application will tell you if you’re approved instantly. Once approved, all you have to do is electronically sign your contract. It’s that easy!

Once you sign your digital agreement, your cash advance will be sent by e-Transfer within 2 minutes. Fast, convenient and hassle-free. Funds are sent 24/7, no matter what.

Have more questions? Check out our full FAQ.