Menu

Table of contents :

This guide provides everything you need to know about payday loans in Ontario, from how they work and what they cost and more!

Unexpected expenses don't wait for payday. Whether you have to travel for an emergency, an expensive vet bill arrives, have to go for an emergency at the dentist, or need to deal with an urgent home repair, you need fast access to cash, and this is where payday loans can be of great use.

If you're considering your first payday loan or want to understand the rules around short-term lending in Ontario, we're here to give you clear, honest and transparent information to help you make the best decision possible.

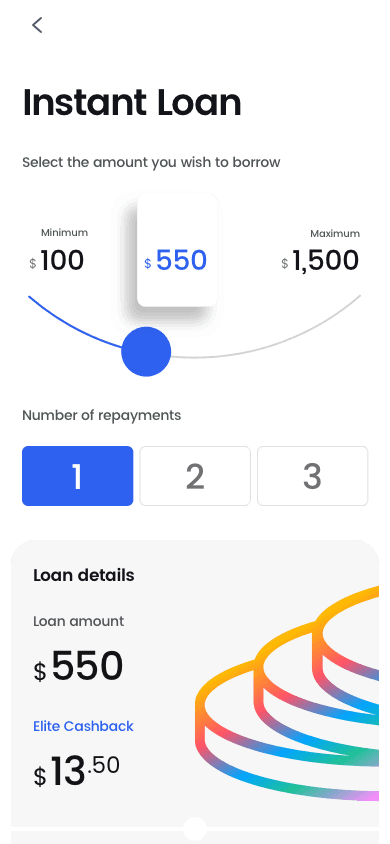

A payday loan is a form of short term borrowing. There aren’t any limitations on how you use the funds, but most people use them to cover immediate expenses until their next paycheck arrives. These loans typically range from $100 to $1,500 in Ontario and are meant to be repaid within a few weeks, usually on your next payday.

Unlike traditional bank loans, payday loans don't require lengthy approval processes or perfect credit scores. They're built for speed and accessibility when you need cash quickly.

Getting a payday loan in Ontario follows a simple process. Here’s what you can expect:

Apply online – Fill out a simple application with a few quick details. Most people only take about 5 to 10 minutes to complete the application.

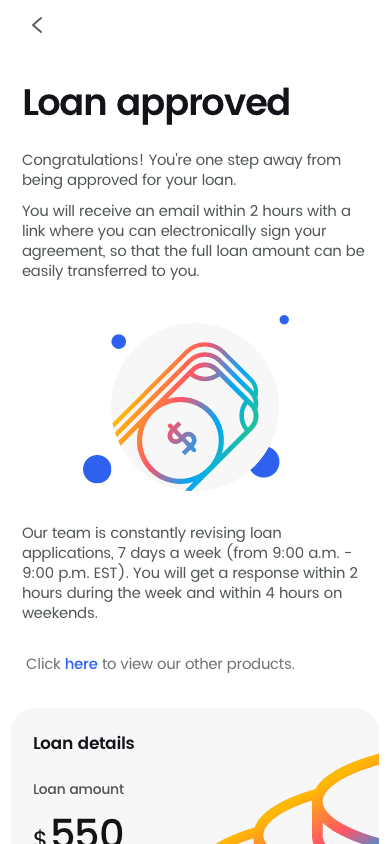

Get an instant decision – We’ll quickly verify your income and banking history using our systems. Many applicants receive approval decisions immediately. No waiting involved!

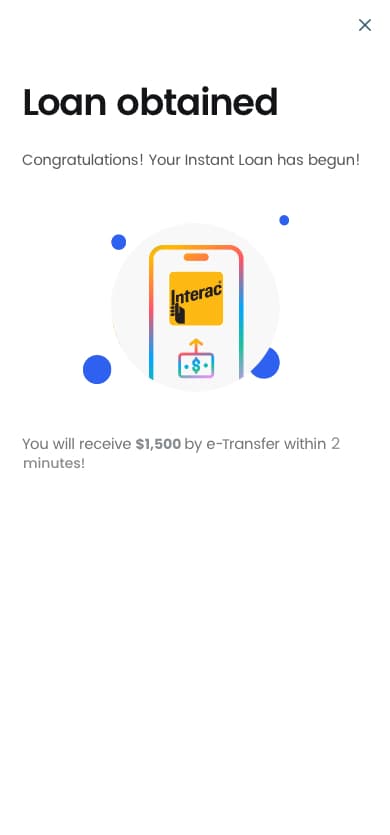

Receive your funds – Once approved and after signing your loan agreement, funds are sent via e-Transfer within 2 minutes. We operate 24/7, so you can access funds any time, even on weekends and holidays.

Repay on your next payday – The loan amount plus fees are automatically withdrawn from your bank account on your agreed repayment date, usually your next payday.

To qualify for a payday loan in Ontario, you need to meet these basic requirements:

Be at least 18 years old (19 years old for applicants in British Columbia, New Brunswick, Nova Scotia)

Be a resident of any of the provinces in which we operate (AB, ON, BC, MB, NB, NS, PEI).

Show that you have been receiving the same source of income for the past three months.

Have a total net income of at least $800/month.

Have access to an online bank account, in which pre-authorized debits can be performed.*

Have a valid Canadian mobile phone number, address, and email address (VoIP numbers are not accepted)

*Please note that KOHO accounts do not qualify as they do not support pre-authorized debits.

iCash welcomes all, and accepts various income types, including employment income, Ontario Works, ODSP payments, CPP, unemployment insurance, and other government assistance programs.

Ontario has some of the strongest payday loan consumer protections in Canada, created specifically to protect borrowers from unfair lending practices.

Every licensed payday lender in Ontario must follow these strict regulations, which limit costs, require clear disclosure of terms, and give borrowers important rights.

It’s important to understand how these protections work, because they help you recognize reputable lenders and know which ones are violating your rights. Let's break down the key rules you need to know.

Borrowing limits: You can borrow up to 50% of your net income per payday loan. However, if you're a repeat borrower taking out another loan within 63 days, the maximum drops to 30% of your net income. This rule prevents borrowers from taking on more debt than they can reasonably repay.

No rollovers or renewals: Ontario law prohibits lenders from rolling over or renewing your loan. This means you cannot extend your loan by paying only the fee and pushing the principal to a later date. This protects you from accumulating excessive fees and entering a debt cycle.

Mandatory loan agreements: Every payday loan must come with a written agreement clearly stating the loan amount, all fees, the total cost of borrowing, and your repayment date. On our end, we ensure all of this important information is spelled out clearly, before you ever sign anything.

In Ontario, the maximum cost of borrowing for a payday loan is $14 per every $100 borrowed. So, what does that look like? Here’s an example:

If you borrow $300, the maximum fee is $42 (3 × $14 = $42). Your total repayment would be $342. If you borrow $500, the maximum fee is $70 (5 × $14 = $70). Your total repayment would be $570.

With the exception of things like late fees and NSF fees, licensed lenders cannot charge you more than this amount, and they cannot add hidden fees or charges. Any lender asking for more is operating illegally, and you should report them to provincial authorities.

Ontario gives you a two-day cooling-off period after taking out a payday loan. During these two business days, you have the right to cancel your loan without paying any fees or penalties. To cancel, you must return the full loan amount to the lender within this window.

This right protects you if you change your mind or simply realize the loan isn't right for your situation. To exercise this right, contact us immediately and we’ll help you through the process.

Having bad credit or no credit history is one of the main reasons people seek payday loans in Ontario. Traditional banks and credit unions usually deny loan applications based solely on credit scores, leaving many Canadians in a predicament during financial emergencies.

Payday lenders take a different approach. Instead of focusing on your credit history, we’re more interested in your current ability to repay the loan and prefer to look at your income and banking patterns. As long as you have a steady source of income and meet the basic eligibility requirements, you can qualify for a payday loan regardless of your credit score.

This is why bad credit payday loans are a great tool for people who might be rebuilding their credit, have experienced past financial difficulties, or simply haven't established a credit history yet. Many payday loan applicants with poor credit scores are approved because lenders like us prioritize current income over past financial mistakes.

iCash.ca provides payday loans to residents across all of Ontario. We serve customers in all major cities and communities throughout the province such as:

Get fast cash in Brantford with instant approval decisions and funding in minutes. | |

Windsor residents can borrow up to $1,500 with transparent fees and no hidden costs. | |

Apply for a payday loan in London online 24/7 and receive funds via e-Transfer within 2 minutes. | |

Toronto borrowers can access emergency cash quickly with our 93% approval rate and flexible repayment options.* | |

Get approved for a loan in Ottawa in just minutes, even with bad credit or no credit history. | |

Whitby residents can apply online for loans up to $1,500 with no paperwork or in-person visits required. | |

Access fast cash in Pickering with our simple online application and same-day funding available 24/7. | |

Hamilton borrowers can get instant approval on loans from $100 to $1,500 with all income types accepted. |

No matter where you live in Ontario, you can apply for a payday loan online from the comfort of your home. Our online application process works 24/7, and funds can be delivered to your bank account via e-Transfer within 2 minutes of approval.

Since 2016, we've helped over 1.6 millions Canadians get instant loans online.

Since 2016, we've helped over 1.6 millions Canadians get instant loans online.

Read more reviews.

Getting an online loan with us is fast and easy. Simply select your loan amount, repayment plan* and provide some personal details.

Our online loan application will tell you if you’re approved instantly. Once approved, all you have to do is electronically sign your contract. It’s that easy!

Once you sign your digital agreement, your cash advance will be sent by e-Transfer within 2 minutes. Fast, convenient and hassle-free. Funds are sent 24/7, no matter what.

Earn money every time you borrow with iCash! Our unique cashback program is designed to reward you for being a loyal customer and can help you save on future loan payments. After successfully paying off your first online loan, you'll receive 4% of the cost of borrowing credited to your account. You can earn up to 12% depending on how many iCash loans you have repaid.

Have more questions? Check out our full FAQ.

Learn about payday loan rules in Ontario, including borrowing limits, fees, borrower rights, and how to verify licensed lenders to stay protected.... Read more